When talking with Bitcoin skeptics, and the possibility of it becoming a global reserve treasury asset for decades to come, it is often met with scrutiny, as such a drastic departure from today’s financial world seems unfathomable. However, just like the past 50 years are not indicative of the next 50 years with the global financial system, the past 12 years of Bitcoin’s history are also not necessarily indicative of the future.

One of the crucial characteristics of Bitcoin is it’s decentralized nature. Similar to how bittorrent enabled file-sharing, a completely peer-to-peer system was required in order to create something which could not be shut down. Bitcoin in this sense is anti-fragile, but is not entirely impervious to existential threats.

Hard-core Bitcoin maximalists would disagree, and have visceral reactions to any outcome where Bitcoin does not become a global reserve currency, but I believe it is also important to keep an open mind and actually evaluate threats as they exist in reality, rather than devolve into the group-think of the masses.

Government Prohibition/Bans.

Control of the supply of money is one of the most powerful tools that governments have. It enables them to run deficits, and finance their operations through methods other than exclusively taxation. The emergence of Bitcoin as a store of value, or reserve asset, and potentially a unit-of-account would threaten government control over money supply, as institutions and individuals could convert their local currencies into Bitcoin, driving up the price of Bitcoin, and reducing the purchasing power of their local currency by effect.

The Bitcoin network, being nearly impossible to shut-down or Bitcoin to be confiscated, represents a threat to all other global reserve currencies being used as a unit-of-account. If the US dollar loses trust or reliability as a unit of account, it is likely that the global market will look to alternatives.

Even though Bitcoin network is nearly impossible to shut down on a global scale or confiscated through traditional means, a government could cut off the fiat rails, by prohibiting banks from transferring money into cryptocurrency exchanges.

There is plenty of precedent for this: In 2017 China banned banks from sending or receiving money from cryptocurrency exchanges. This forced residents to trading bitcoin on foreign exchanges, or transacting peer-to-peer. plenty of actions by CCP, Bitcoin mining still continues to remain primarily in China. As we speak, other countries who are in financial turmoil begin to ban Bitcoin, the most recent of which is Nigeria.

The US and its reserve currency status holds a disproportionate amount of leverage over global trade and other countries, as all commodities are denominated and settled in US dollars, creating an unlimited amount of demand for it’s money. Some countries even restrict the ownership of US dollars, as the local government require them to be able to import commodities. For this reason, the US has the most to lose in terms of power. With mining being so heavily concentrated in China, it is feasible that the US could also prohibit fiat rails into cryptocurrency exchanges under a “national security” pretense.

Despite having the most to lose, as both US retail and institutional investors purchase bitcoin as a treasury reserve asset, it becomes less likely that the US would be able to pass legislation to ban Bitcoin. Many US based institutions have added bitcoin to their reserve treasuries. Recent estimates of the percentage of US retail investor who own Bitcoin are as high as 11% . Some of the largest exchanges and custody providers are US based. Institutions and high-net-worth individuals have legal teams ready to fight for their own self interests in court, and it has been debated if Bitcoin code could be protected by free-speech laws.

With that being said, the threshold for the US implementing broad sweeping policies under national security pretense, against the interest of its population or institutions is remarkably high, and it is unwise to completely disregard this threat in the short-term.

Dethroned by a competitor.

Since the inception of Bitcoin, over 4000 other cryptocurrencies, also know as alt-coins (or shit-coins in the words of Bitcoin maximalists) have also been created. Many of these have touted themselves as Bitcoin 2.0, better, faster, cheaper.

Metcalf’s Law, or “network effects” dictates that the more people that own/use Bitcoin, it is exponentially valuable to other users of bitcoin. You can see the effect of Metcalf’s law in the scale of the top tech companies which act as networks, Facebook, Amazon, Google, or just the internet in general are all examples of how powerful network effects can be. Because of this, cryptocurrencies, a monetary or value network, has a high probability of a “winner-takes-all” outcome.

Alt-Coins

When looking at other cryptocurrencies, you need to ask yourself: what problem does this other cryptocurrency actually solve which Bitcoin does not? Many people have pointed a proof-of-stake consensus mechanism being a cheaper alternative to proof-of-work and therefore better. The problem is that proof-of-stake incentive structure leads to more centralized outcomes, which compromises the security and integrity of the network. In proof-of-stake, large holders, who have a disproportionate amount of influence on the governance of the network can be compromised, or coerced into acting against their own interests, or the interests of the network.

There are other problem sets which alt-coins try to solve, which are thought to not be possible with Bitcoin. Smart contracts and faster transactions with lower fees. Development continues to happen on top of the Bitcoin protocol: RGB is developing a smart contract platform using the bitcoin network and the Lightning and Liquid networks are second layer solutions to enable applications such as Strike. One way to think about second layer solutions is their similarity to HTML (smart contracts), being developed for usage on top of HTTP (Bitcoin) at the advent of the internet. Ultimately, it seems that each additional problem that alt-coins look to solve will eventually be handled on the Bitcoin network, in which case there is only a need for there to be one.

Central Bank Digital Currencies.

Many governments are in the process of creating central bank digital currencies (CBDCs). These CBDCs will likely have the advantages of Bitcoin and make the storage, audit, and exchange of digital cash easier. What CBDCs will not replace is Bitcoin’s use as a store-of-value, as the monetary policy of CBDCs will be the same, and influenced by the same motivations as our fiat currency is today. No one believes that central banks will diverge from the inflationary monetary policies that exist today.

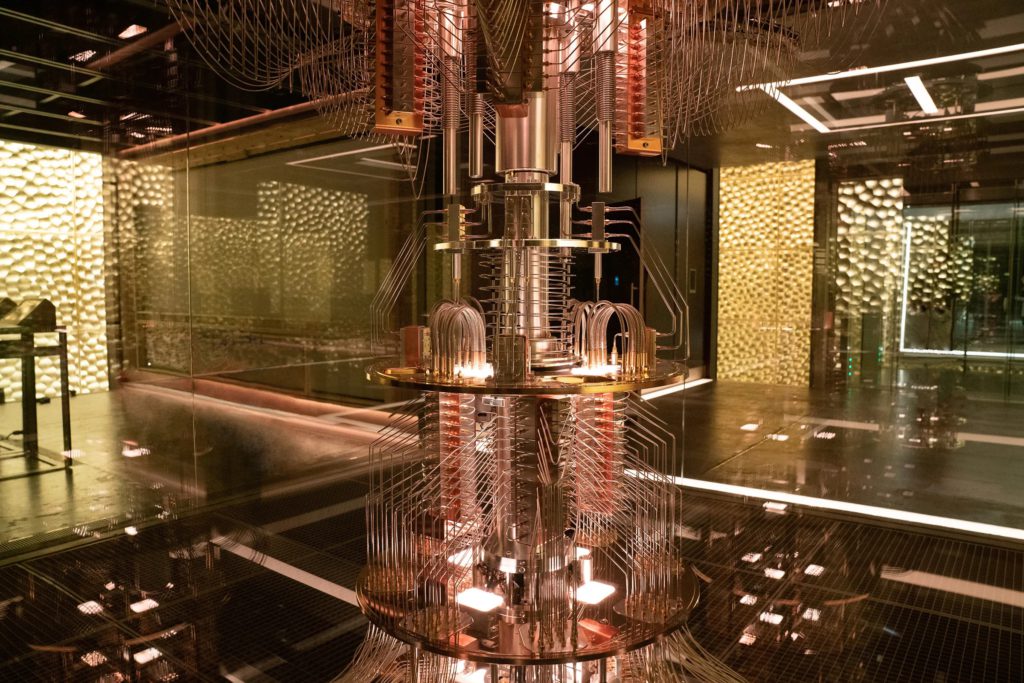

Hacked by Quantum Computers

Quantum computers, possessing exponentially larger amounts of computing power than are available today, will likely crack our existing encryption algorithms. It is theorized that it will require 3000 qubit computers, which could be as close as five years away.

Thankfully, as this threat looms closer, the Bitcoin network has the opportunity to upgrade its protocol to migrate to a quantum-resistant encryption standard, provided that a majority of the network participants (nodes and miners) agree to upgrade the network via thorough consensus. The process of getting an upgrade through which makes such a drastic change to a fundamental component will certainly be challenging (see the segwit2x saga) but a looming existential threat should muster enough urgency to get the upgrade done.

It probably won’t die.

I believe that the most likely grim reaper of Bitcoin was the intervention of governments, as it was the only vector which was completely outside the Bitcoin network’s control. Bitcoin seems to be crossing, or has already crossed this chasm, with US institutions adopting bitcoin at a faster rate, than legislation could likely be passed. The moment that the first pension funds begin hopping on-board this new asset, it will be past the point of no return, and it is very likely, if not already certain, that Bitcoin will be around for a very, very long time.